ohio sales tax exemption form reasons

Real property under an exempt construction contract. Be sure that you are not paying sales tax on purchases from.

Tax Exemption Form Fill Out And Sign Printable Pdf Template Signnow

If purchasing merchandise for resale some wording regarding the resale of products will likely be included.

. In addition to requiring purchaser information such as name address and business type Ohio. In Ohio certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. These include construction contracts whereby building materials are incorporated into real property under a contract with a government agency or into a horticulture or livestock.

If you are a retailer making purchases for resale or need to make a purchase that is exempt from the Ohio sales tax you need the appropriate Ohio sales tax exemption certificate before you can begin making tax-free purchases. Sales tax exemption in the state applies to certain types of food some building materials and prescription drugs. Construction contractors must comply with rule 5703-9-14 of the Ad-.

Construction contractors must comply with rule 5703-9-14 of the Administrative Code. This page explains how to make tax-free purchases in Ohio and lists three Ohio sales tax. To claim the Ohio sales tax exemption for manufacturing qualifying manufacturers need to complete Ohio sales tax exemption Form STEC B which is a Sales and Use Tax Blanket Exemption Certificate and provide a copy of this certificate to their vendors.

Step 2 Enter the vendors name Step 3 Describe the reason for claiming the sales tax exemption. The Ohio sales and use tax exemption for manufacturers allows businesses to purchase tangible personal property to be used or consumed in the manufacturing process free from the Ohio sales and use tax. The sales and use tax is Ohios second-largest source of revenue.

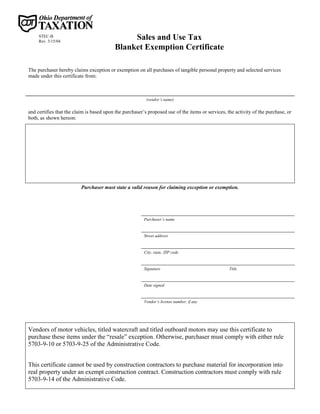

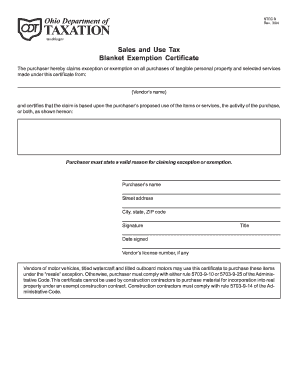

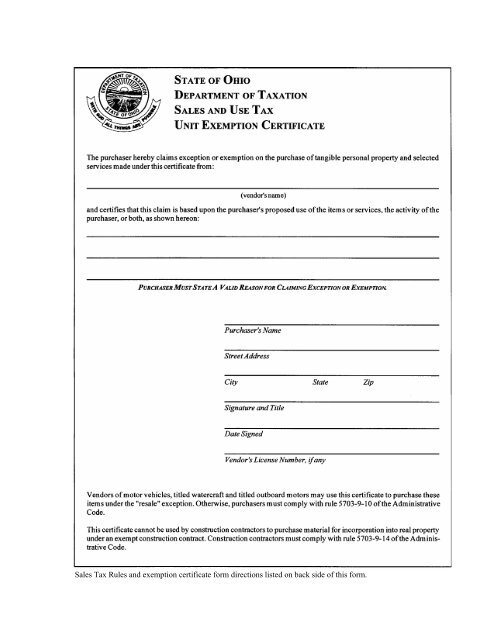

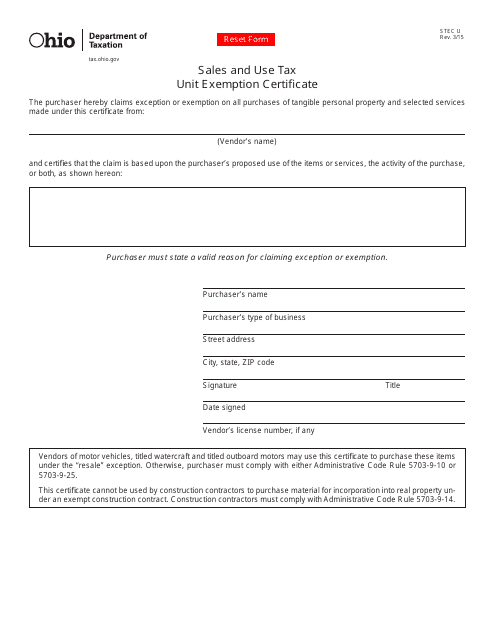

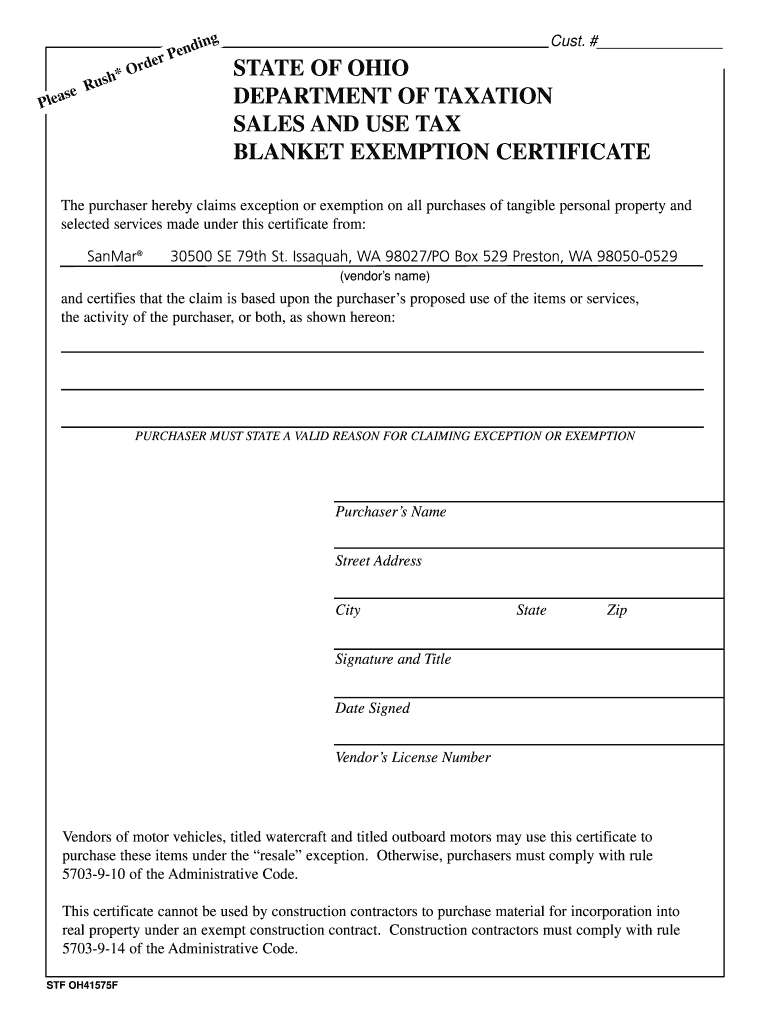

Download Or Email STEC B More Fillable Forms Register and Subscribe Now. The Ohio sales and use tax dates back to 1934 when the Ohio General Assembly enacted its first tax at 3. The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected services made under this certifi cate from.

Ad New State Sales Tax Registration. Purchaser must state a valid reason for claiming exception or exemption. Microsoft Word - Sales Tax Exemption Formdoc.

Ohio Sales Tax Exemption Form On the other hand contractors may purchase materials exempt from Ohio sales and use tax based upon an exempt real property improvement. This represents a significant and important savings that manufacturers shouldnt overlook. The Ohio Sales Tax Exemption Form is a helpful resource that breaks down the exemptions by category.

Purchasers name Street address City state ZIP code Signature Title Date signed Vendors license number if any Vendors of motor vehicles titled watercraft and titled outboard motors may use this certificate to. Purchaser must state a valid reason for claiming exception or exemption. Purchasers name Street address City state ZIP code.

Beginning of the Manufacturing. Sales and Use Tax Blanket Exemption Certificate taxohiogov. Purchaser must state a valid reason for claiming exception or exemption.

Sales Tax Exemption State information registration support. 573902B1 SR Salvage Resale A salvage dealer taking a salvage title to a vehicle that is to be dismantled and sold as parts may claim an exemption from sales tax. You will see details about the type of form you need to prepare in the table.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Tax-exempt items and services include. Vendors name and certifi or both as shown hereon.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Property under an exempt construction contract. Step 1 Begin by downloading the Ohio Sales and Use Tax Exemption Certificate STEC U for a single transaction or STEC B for multiple transactions.

The improvement of health through the alleviation of illness disease or injury. Knowing which items are exempt from sales tax can save you money when shopping in Ohio. A Salvage Dealer Permit and Vendor License are required.

SP StatePolitical Subdivision - The State of Ohio or any political subdivision thereof is exempt from sales tax on motor vehicles. An example reason for the purposes of completing the form could read purchases used for agriculture horticulture or floriculture production. Restaurant meals may also.

Charitable purposes means the relief of poverty. Ohio Sales Tax Exemption Resale Forms 3 PDFs. Sales of certain items are exempt from sales and use tax.

As of August 2011 Ohio imposes a 55 percent sales and use tax on qualifying retail transactions and. 1 Where materials handling from initial storage has ceased. 1 If a vendor seller or consumer is purchasing a motor vehicle a watercraft that is required to be titled or an outboard motor that is required to be titled and is claiming exemption from the sales and use tax based on a reason other than resale the vendor seller or consumer must comply with rule 5703-9-10 or 5703-9-25 of the Administrative Code.

The operation of an organization exclusively for the provision of professional laundry printing and purchasing. A completed form requires the vendors name the reason claimed for the sales tax exemption and the purchasers name address signature date and vendors number if the purchaser has one. Ad Download Or Email STEC B More Fillable Forms Register and Subscribe Now.

This form is updated annually and includes the most recent changes to the tax code. 2 Where materials handling from the place of receipt ceases wo initial storage 3 Where materials have been mixed measured blended heated cleaned or otherwise treated or prepared for the manufacturing process. The state sales and use tax rate has been 55 percent since July 1 2005.

The purpose of this article is to help clarify the Ohio Sales Tax Exemption for Ohio Farmers. Sales to nonprofit organizations operated exclusively in Ohio for certain charitable purposes as defined in sales tax law as follows. 4 Different materials can have different points of commitment.

Exempted by Ohio Revised Code Section 573902 B-1 Ohio Department of Transportation 1980 West Broad Street Columbus OH 43223 State Government CFO 182021 TIN 311334820. Sales and Use Tax Blanket Exemption Certificate. Reasons for Tax Exemption in Ohio Sales and Use Tax.

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Farm Bag Supply Supplier Of Agricultural Film

Ohio Tax Exempt Form Holland Computers Inc

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

New Bulletin Explains Ohio S Sales Tax Exemptions For Agriculture Farm Office

What Is A Sales Tax Exemption Certificate And How Do I Get One

Printable Ohio Sales Tax Exemption Certificates

Ohio Sales Tax Exemption Signed South Slavic Club Of Dayton

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Tax Exempt Form Ohio Fill And Sign Printable Template Online Us Legal Forms

Ohio Sales Tax Exemption Fill Out Printable Pdf Forms Online

Fill In Blank Tax Exemption Form Ohio Fill And Sign Printable Template Online Us Legal Forms

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller